Ways Of Giving

Braemar Community Limited is a registered charity and we can accept grants, gifts in cash or shares and legacies. Tax-effective gifts may be made by making a Gift Aid declaration and higher-rate tax payers may themselves benefit from the tax advantages of charitable giving.

If you would like to discuss your gift, what it can help achieve and how it may be recognised please contact us.

Recognising Your Support

We would like to recognise every gift in a form that the donor chooses – their own name, that of their family or perhaps in memory of a loved one. All gifts will be recognised on our website and the names of donors of donations over £400 will be recorded on a panel in the castle reception. In addition, we will use this information to ensure that you hear of progress towards reopening.

Gift Aid Donation

If you are a UK tax payer, you may support Raising the Standard campaign by making a Gift Aid donation. This means that we may reclaim from HMRC the basic rate tax on your gift (at no cost to you). This increases the value of your gift, so that a gift of £100 is worth £125 to the campaign.

For a higher-rate tax payer, you receive a tax advantage which represents the difference between the basic tax rate and your own. (Thus a £100 donation would represent a £75 “cost” to a 40% tax payer).

*Donate button will take you to our JustGiving page where you have the option to elect to donate under Gift Aid.

Cash Donation

If you are not a UK tax payer or do not pay more tax than would be claimed on your donations in any one tax year, a donation of cash, shares or property that may be realised for the benefit of the campaign is very welcome.

*Donate button will take you to our JustGiving page where you have the option to elect to donate under Gift Aid.

Bank or Cheque Transfer

If you prefer to give by BACS, please give to Braemar Community Limited using sort code 80-05-51 and account code 06000407 using reference DONATE – “Surname”

If you wish to write a cheque please make it payable to “Braemar Community Limited” and send it to:

Braemar Community Limited

Braemar Castle Braemar

Aberdeenshire AB35 5XR.

If you would like this BACS/ Cheque donation to be eligible for gift aid please complete the attached form.

Donate

Partners and Founders

We are very grateful to all our partners and funders who are supporting the project and its objectives.

Partners

Funders

Donation Methods

Gift Aid Donation

Cash Donation

Gift of shares

Bank transfer

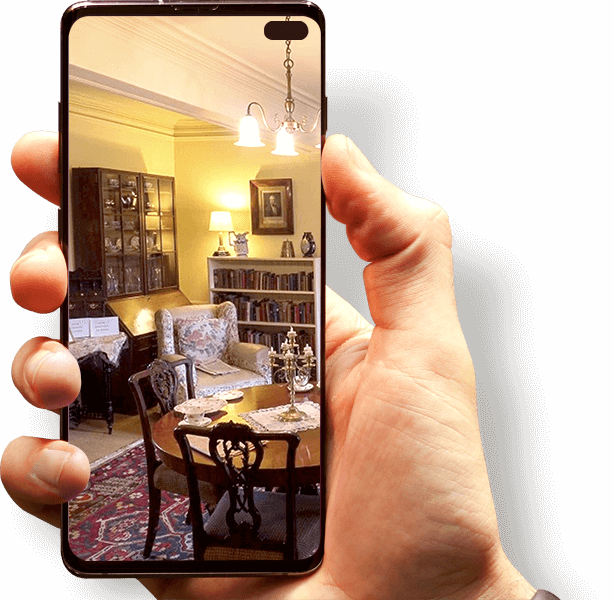

Virtual Castle

Closing the distance between the castle and visitors - take a tour, sign up for the events and meet the people behind the castle walls. Whether you are at home or abroad we invite you to enjoy everything we have on offer.

What's On

Watch this space!

The Castle is now closed to the public as contractors start their 18 month capital works improvement programme.

Activities and events linked to these major works are scheduled for 2022 and beyond.

Keep watching this space for future information.